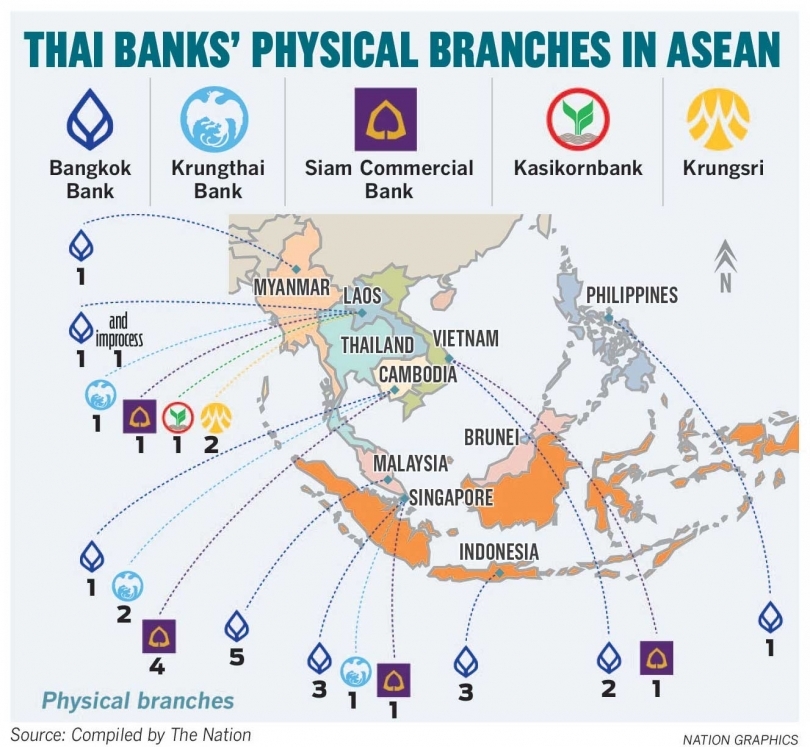

DESPITE the proliferation of technology, Thai banks still see a necessity to establish a physical presence. In this regard, Thailand’s largest bank, Bangkok Bank, is in the best position to cash in on the Asean Economic Community (AEC) with its presence i

BBL's international loans - those extended to businesses outside Thailand - account for 18-20 per cent of its total lending.

Maintaining physical branches is a key strategy for BBL, and it has been ready to open more branches in each country if it sees significant activities from customers.

Its strategy for Indonesia speaks to this. After opening a branch in Jakarta, BBL scaled up its presence with the opening of two more in Surabaya and Medan to satisfy demand from Thai and multinational companies. A year after the opening of the two additional branches, Indonesia is now the bank's second-biggest overseas market in terms of loan approvals, of the 14 markets it has been operating in.

The same strategy will be applied with its expansion plan in Laos. It already has a branch in Vientiane, and will soon open one more in Pakse, in the country's south.

Kobsak Pootrakool, executive vice president for international banking at BBL, said digital banking might suit individual consumers, but for corporate banking, especially overseas, physical branches and local knowledge were needed.

"A key to banking overseas is understanding the regulations. We have to use local knowledge to contact regulators and clients. The lending process needs to use people, so having physical branches is meaningful for the bank when conducting corporate banking overseas," he said. BBL is the only Thai bank to receive a foreign banking licence in Myanmar.

Connectivity in Asean is an advantage for BBL when offering integrated services. The bank has set up an Asean Connect Desk at its headquarters in Bangkok to advise entrepreneurs wishing to do business in both Asean and border provinces.

Chartsiri Sophonpanich, president of BBL, has said the bank has to understand the development of each business, and lending is not always the answer for clients.

"To step into Asean, enterprises have enough funds, but what they want to know is how financial institutions will help them conduct offshore business successful. Therefore, advisory service is the first focus for BBL. When those businesses develop, funding will be the next stage," Chartsiri |said.

Physical presence also matters for other Thai banks that want to establish footprints overseas, particularly in Asean. But only large banks find this palatable as branches require a major investment.

READ FULL STORY