The baht continued to weaken, trading at 31.70 to the US dollar in Monday morning trade, amid concerns over the coronavirus spreading outside China.

Kasikorn Research Centre said that the baht had weakened along with the yuan and other regional currencies amid concerns about the Covid-19 outbreak, after there was an increase in Covid-19 infections outside China.

SET plunges along with Asian stocks due to concerns over Covid-19

In addition, the baht fell on technical selling orders after it broke the Bt31.50/dollar level. Signs of a weak economic outlook, as well as net foreign selling orders for Thai stocks and bonds pressured the baht sentiment, while the US dollar rose on positive views on the US economy, according to the latest Federal Open Market Committee minutes.

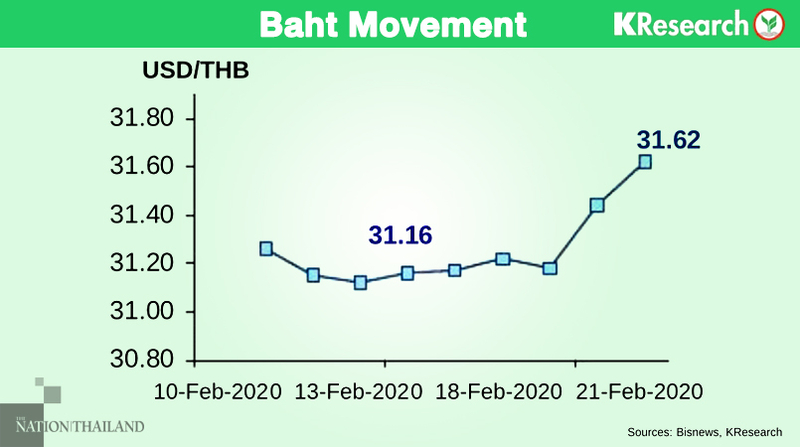

On Friday, the baht had closed at 31.62/dollar, having hit an eight-and-a-half-month low of Bt31.69/USD, versus Bt31.16/dollar reported on February 14.

During February 24-28, KBank expects the baht to move within a range of Bt31.40 to Bt32/dollar. Key factors to be monitored closely are Thai export data for January, the Bank of Thailand’s monthly economic report and the Covid-19 outbreak situation, said Kasikorn Research Centre.

Meanwhile, the US economic data to be released during the week include February consumer sentiment surveys, plus February durable goods orders, new home sales, pending home sales, personal spending-income, and PCE/Core PCE price indices, fourth quarter 2019 GDP report (second release) and December house price data, the research house added.